Validating KPIs for the object-centric Deductions Leakage app

Work through the steps in the Setup and Validation view to change the default parameters for the Deductions Leakage app. We explain how we calculate each KPI, and what parameters the app uses by default. You can change the parameters to align with how things are done in your organization.

Tip

After you publish an app for the first time, changing variable values in the Setup and Validation view in Studio doesn’t change their values in Apps. After publishing, you’ll need to work with the views in the Apps area in order for the values of the settings to be applied for end users. It’s best to keep the two sets of variable values in sync so that your results in Studio match those in Apps.

The Setup and Validation view is the best way to validate and adjust the KPIs in the Deductions Leakage app’s Knowledge Model. If you’ve worked through a use case there but something is still not the way you want it, you can make further adjustments directly in the Knowledge Model in Studio.

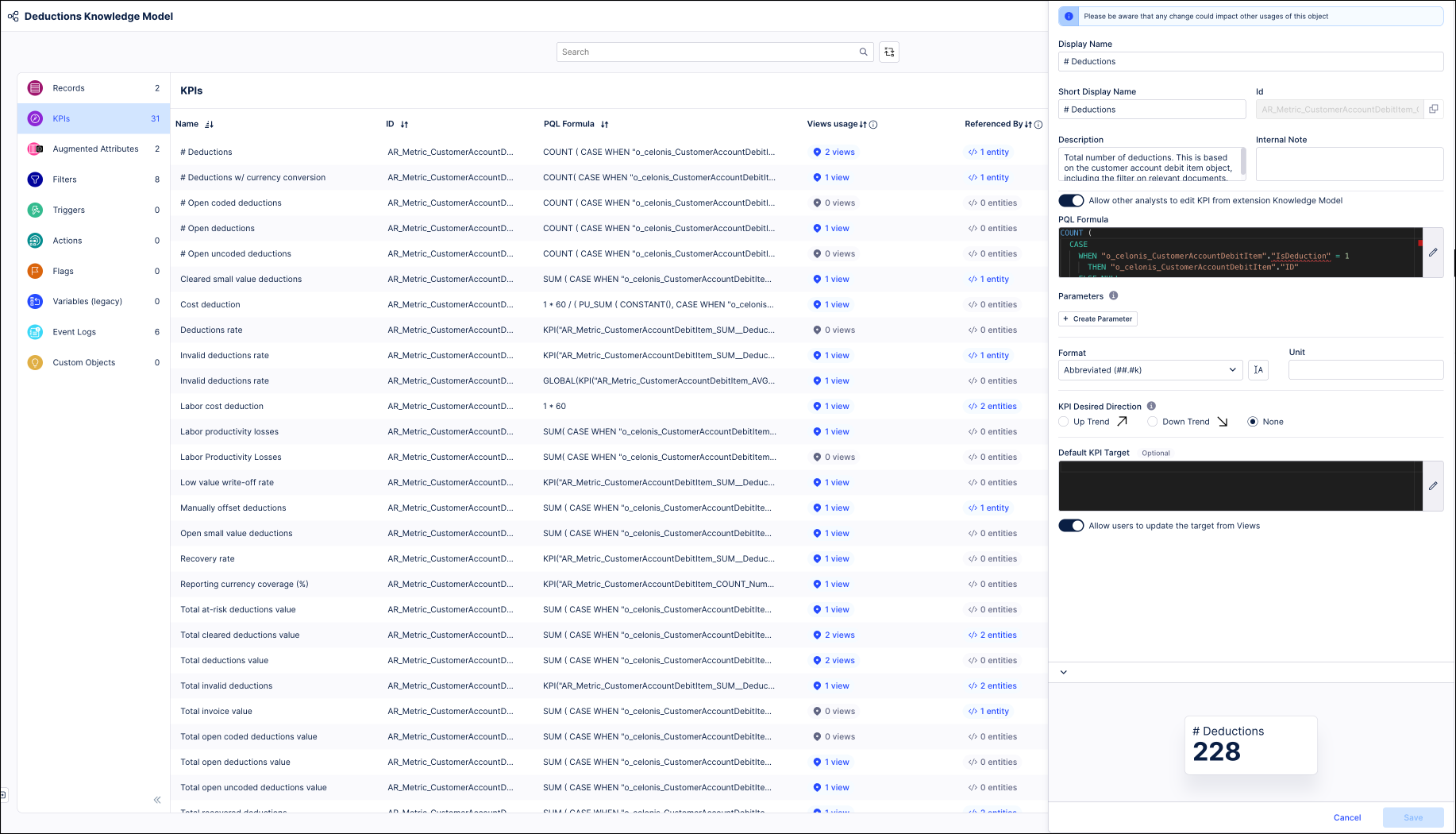

The Knowledge Model for the Deductions Leakage app is called “Deductions Knowledge Model”. You’ll need Analyst permissions on Studio and the Knowledge Model to update it. Each KPI contains a PQL (Process Query Language) formula which you can change in our editor to change how the KPI behaves. Your changes are applied when you publish a new version of the app.

The Knowledge Model also includes calculated attributes that contain the business logic to classify and provide metadata about objects. You can use them in PQL queries as if they were another column in the database table for the object type. They appear in the Knowledge Model as attributes of relevant records. If you make any edits to view components that involve the calculated attributes from the Knowledge Model, we’ll automatically update the calculated attributes in the Knowledge Model to match your edits. You can also adjust them directly in the Knowledge Model before or after editing the views.

Calculated attributes and PQL formulas might be reused in the calculations for several KPIs across the Knowledge Model. If you change the business logic in one location and save your change, all of the KPIs that reuse the calculated attribute or PQL formula will reflect your changes.

Here’s how to work with the KPIs and calculated attributes in the app’s Knowledge Model. If you need training, check out the training track “Build Knowledge Models and Views” on the Celonis Academy.

In the Celonis navigation menu, select Studio.

In the Studio overview, find the Deductions Leakage app in the space where you installed it, and click its tile.

Select the Knowledge Model from the app navigation.

Select the KPIs section of the Knowledge Model to work with KPIs, or the Records section to work with calculated attributes.

You can sort and search the KPIs using their name or ID. The prefix to the ID shows what type of component they are. The table at the end of this topic lists the calculated attributes for the Starter Kit, with the records where you can find them and the use cases they apply to.

To see and edit the full PQL formula and other settings for a KPI or calculated attribute, click its row to open an editor. The editor automatically validates any changes that you make in the PQL formula.

If you want a fuller-featured PQL editor that lets you select from the tables and columns in your data, click on the pen icon next to the PQL formula.

If you need to disable a KPI or formula, click the three vertical dots at the top of the editor, and select Disable Scope, then click Disable to confirm. When you do this, the object can't be accessed or used anywhere in the package, including by other apps that depend on it.

When you’ve made changes to the KPIs and calculated attributes, use the Publish button at the top of the screen in your Studio space to publish a new version of the app.

Here are the calculated attributes for the Deductions Leakage app:

Calculated Attribute name | Attribute ID | Record ID | Use cases | Description |

|---|---|---|---|---|

Is Deduction | IsDeduction | O_CELONIS_CUSTOMERACCOUNTDEBITITEM | Generic | Flag which defines if an item is a deduction. |

Is Coded Deduction | IsCodedDeduction | O_CELONIS_CUSTOMERACCOUNTDEBITITEM | Generic | Flag which defines if a deduction is coded or uncoded. This is based on user selections for an unassigned reason code. |

Credited item | DeductionIsCredited | O_CELONIS_CUSTOMERACCOUNTDEBITITEM | Recovery Monitor | Deduction is considered as credited when it only has credit memos in its clearing assignment. |

Repaid item | DeductionIsPaid | O_CELONIS_CUSTOMERACCOUNTDEBITITEM | Recovery Monitor | Deduction is considered as paid when it only has payments (no credit memos) in its clearing assignment. |

Written-off item | DeductionIsWrittenOff | O_CELONIS_CUSTOMERACCOUNTDEBITITEM | Recovery Monitor | Deduction is considered as written off when it has no payments or credit memos in its clearing assignment. |

Manually offset item | DeductionIsManuallyOffset | O_CELONIS_CUSTOMERACCOUNTDEBITITEM | Recovery Monitor | Deduction is considered as manually offset when it only has payments and credit memos in its clearing assignment and can't be categorized as recovered or credited. |

Clearing type | ClearingType | O_CELONIS_CUSTOMERACCOUNTDEBITITEM | Recovery Monitor | Defines the clearing type of a deduction based on the other documents in its clearing assignment. |

Credit memo | IsCreditMemo | O_CELONIS_CUSTOMERACCOUNTCREDITITEM | Recovery Monitor | Flag which defines if an item is a credit memo based on document type and transaction type. |

Incoming payment | IsIncomingPayment | O_CELONIS_CUSTOMERACCOUNTCREDITITEM | Recovery Monitor | Flag which defines if an item is an incoming payment based on document type and transaction type. |

At risk deduction | OpenAtRisk | O_CELONIS_CUSTOMERACCOUNTDEBITITEM | Open Deductions | Deductions at write-off risk due to their age. By default, the aging threshold is set at 90 days but is user configurable. |

Quantity comparison | SalesOrderItemDeliveriesQuantityComparison | O_CELONIS_SALESORDERITEM | Open Deductions | Compares the ordered quantity on a sales order line against total delivery quantity of all related delivery lines. It returns 'Units mismatch' if the units between the items are different and a comparison is not possible. |

# Price increases | NumberOfPriceIncreases | O_CELONIS_SALESORDERITEM | Open Deductions | Counts the number of increases to the net unit price of the sales order item. |

Price comparison | PriceComparisonToSalesOrderItem | O_CELONIS_CUSTOMERINVOICEITEM | Open Deductions | Compares net unit prices of customer invoice items against sales order items. It returns 'Currency mismatch' if the currencies between the items are different and a comparison is not possible. |

Below deduction cost | DeductionIsBelowDeductionCost | O_CELONIS_CUSTOMERACCOUNTDEBITITEM | Small Value Deductions | Deduction is considered below the cost of processing considering invalid probability and labor costs. |