Validating KPIs for the case-centric Open Credit Memo app

In the Open Credit Memo app’s Knowledge Model, check that the KPIs (key performance indicators) contain the correct business logic for your organization. For the Open Credit Memo app, you can manage the settings for most of the important KPIs using the Validation and Value Assessment view and Settings view, but some KPIs can only be managed in the Knowledge Model.

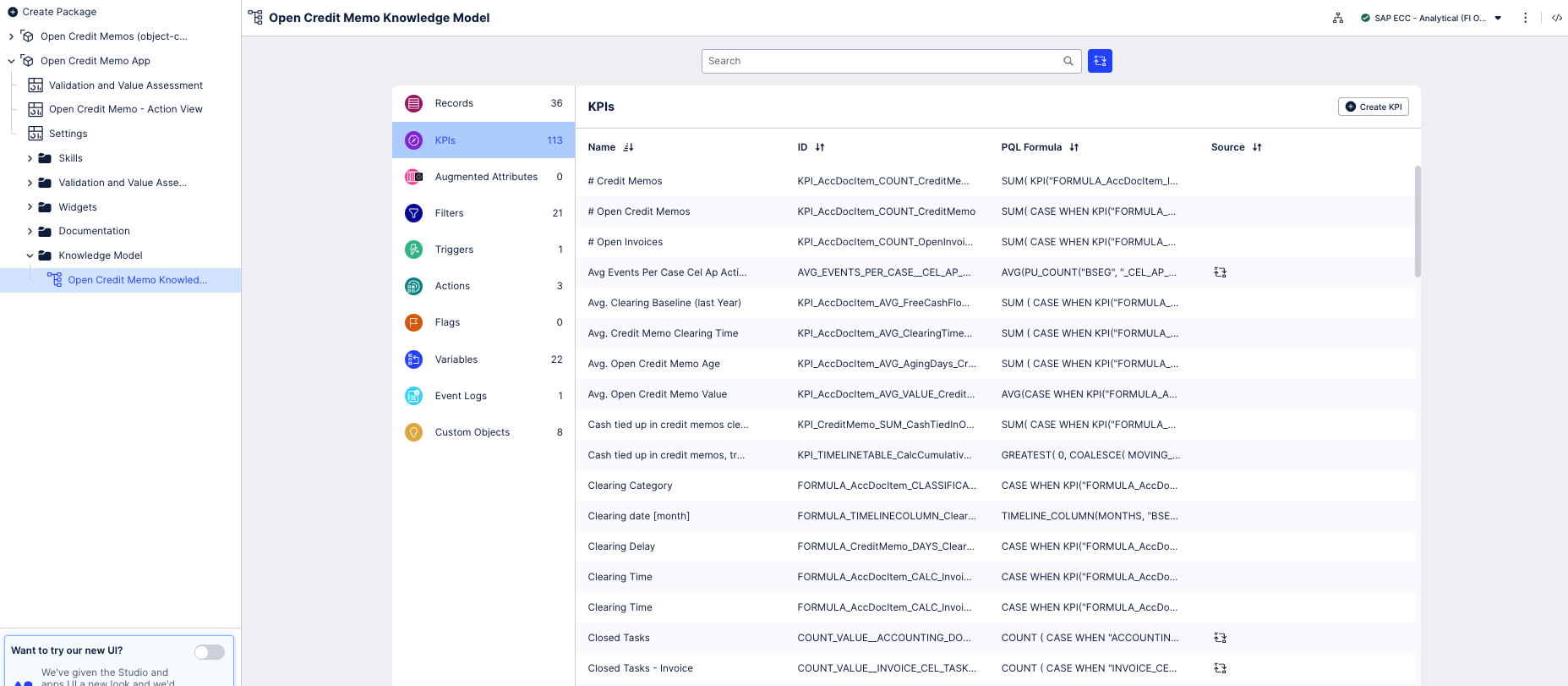

The main Knowledge Model for the Open Credit Memo app is “Open Credit Memo Knowledge Model”, which is in the app’s Knowledge Models folder. Work with this Knowledge Model to validate and change KPIs. “Open Credit Memo Knowledge Model” points to the base Knowledge Model stored in the Celonis Marketplace, which you can’t update directly. Changes that you make to the PQL formulas, KPI names, or formatting in “Open Credit Memo Knowledge Model” override the base Knowledge Model.

Each KPI in a Knowledge Model contains a PQL (Process Query Language) formula. Some KPIs are reused inside other KPIs as nested formulas. When you adjust the business logic in a single formula, and save it, the change is simultaneously reflected in all the KPIs that reuse the formula.

You work with Knowledge Models in Studio, and any changes you make are applied when you publish a new version of the app. You’ll need Analyst permissions on Studio and the Knowledge Model to modify any of the KPIs and their calculations. If you need training, check out the training track “Build Knowledge Models and Views” on the Celonis Academy.

Here’s how to work with the KPIs in “Knowledge Model ”:

In the Celonis navigation menu, select Studio.

Find the Open Credit Memo app in your Studio space navigation.

Expand the package’s structure using the arrow.

Go to the Knowledge Models folder and select “Open Credit Memo Knowledge Model”.

Select the KPIs section of the Knowledge Model.

You can sort and search the KPIs using their name or ID. The prefix to the ID shows what type of component they are. At the end of these instructions, we’ve noted the most important KPIs to check.

To see and edit the full PQL formula and other settings for a KPI, click its row to open an editor. The editor automatically validates any changes that you make in the PQL formula.

If you want a fuller-featured PQL editor that lets you select from the tables and columns in your data, click on the pen icon next to the PQL formula.

If you need to disable a KPI or formula, click the three vertical dots at the top of the editor, and select Disable Scope, then click Disable to confirm. When you do this, the object can't be accessed or used anywhere in the package, including by other apps that depend on it.

When you’ve made changes to the KPIs, use the Publish Package button at the top of the screen in your Studio space to publish a new version of the app.

For the Open Credit Memo app, an important pair of KPIs that you can only manage in the Knowledge Model is:

FORMULA_CreditMemo_CALC_Prioritization

FORMULA_CreditMemo_CALC_OpenPrioritizationScore

These KPIs define how items are prioritized in the Action View. With the default settings, prioritization for items is based on the value impact.

The app prioritizes credit memos using calculations based on the profit and loss impact if the age is over the free cash flow threshold, or the free cash flow impact if the age is below the free cash threshold. For aged items, this is the item's full value. The free cash flow impact is the annualized impact of not invoicing the item for an additional day. A priority icon is assigned according to whether the value exceeds the first quartile (low), second quartile (medium), or third quartile (high) of the realizable value.

The Knowledge Model variable “Current Date” (with the ID AP_Variable_Input_CurrentDate) is relevant if you are analyzing a one-time extract of data taken in the past. The default setting is TODAY(), but if you set a fixed date on which the data extract was made, credit memo aging is calculated as if that date were today. That means you won’t see incorrect results due to including the days since the data extract and overaging the credit memos.